Apple Pay is the talk of the media, but will we ever be rid of cash? Are we moving to a totally plastic/credit/debit society? Not according to the latest research from The Federal Reserve Board and APG, among others. The amount of cash in circulation continues to climb – by a little more than 7.3% in the last year alone. In fact, in certain niches, cash rules!

Apple Pay is the talk of the media, but will we ever be rid of cash? Are we moving to a totally plastic/credit/debit society? Not according to the latest research from The Federal Reserve Board and APG, among others. The amount of cash in circulation continues to climb – by a little more than 7.3% in the last year alone. In fact, in certain niches, cash rules!

Two interesting facts:

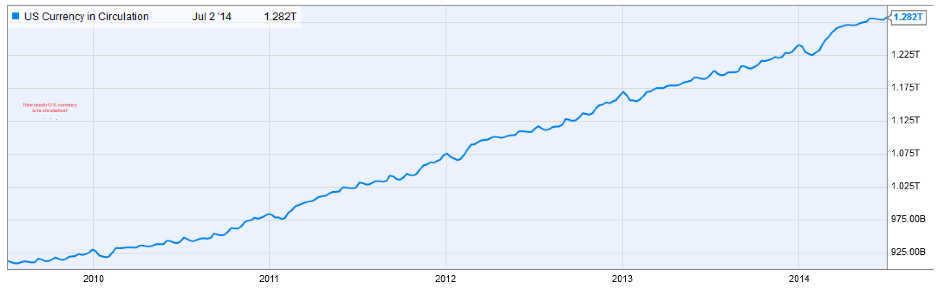

The amount of cash in circulation has increased by almost 40% in just the last 4 years from $925 billion to 1.286 trillion now (up $88 billion in the last 12 months)*

Up to 60% of a retailer’s transactions are in Cash – (Source: Federal Reserve Bank of San Francisco Report, 4/14 ) While this varies greatly from retailer to retailer, cash remains very popular in certain niches including food and personal items.

Six Reasons Why Cash Will Remain King

1. It’s universal. Cash is accepted everywhere from mom-and-pop shops to big chains.

2. It’s fast.

3. It’s influential. The immediacy of cash lends negotiating power to it’s holder.

4. It’s anonymous. People like privacy and cash affords them that luxury.

5. It’s simple. There is no hidden fee structure, just a simple, single transaction.

6. It’s direct. It’s tactile and works in “real time”.

So – despite the fact that many of us seem to be using our debit, cards, credit cards and mobile loyalty programs more than ever – cash is also on the rise.

Comments are closed.